If you ship to a country with customs clearance, your shipment will be checked by customs in that country. Therefore, it is mandatory to include the customs forms with your shipment. You require commercial invoices for commercial shipments. A pro forma invoice is often sufficient for non-commercial shipments. However, this varies from country to country.

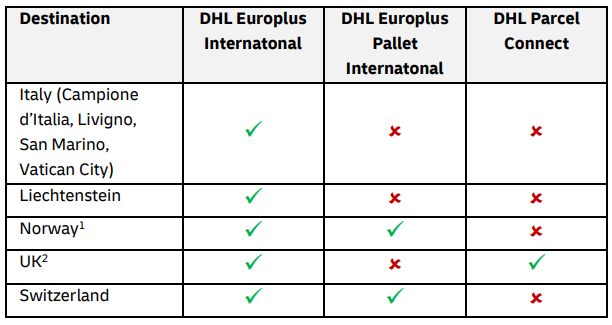

To which customs territories can you ship with DHL eCommerce?

- Norway: shipping DDP to Norway is not possible.

- UK: no customs formalities needed for Northern-Ireland. The standard delivery method for parcels to consumers in the UK is Incoterm DAP.

Does you invoice meet all the requirements?

The invoice must always comply with the legal requirements, otherwise there is no right to deduct VAT or shipments may be delayed or not imported. You can easily generate a correct invoice when preparing your shipment in My DHL Portal. Check the manual for more information.

Invoice requirements for dutiable shipments

Attention: Specific requirements apply for shipments to the UK. Check our Brexit information page for more details.

How to submit your customs paperwork?

- Print and combine all the documents for your shipment (typed and completed in English). This includes invoices, a copy of the shipping label, a tax reclaim form, certificates, export documents, etc. Handwritten documents are not accepted.

- Keep the copies and attach the original documents to the parcel in a doculope (self-adhesive document-enclosed envelope).

- Supply a digital copy of the documents to DHL via our online shipping tool My DHL Portal or with our special customs API. If you are unable to share the paperwork via digital means or e-mail ([email protected]), an extra set of documents must be attached to the shipment.